- Financial Survival Network

- Posts

- CPI Set For “Historic” Drop Over “Next Two Months”

CPI Set For “Historic” Drop Over “Next Two Months”

from Zero Hedge

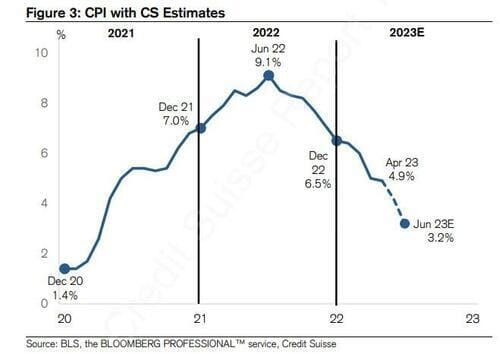

Earlier today, we said that tomorrow’s CPI print is “the event of the week in terms of potential vol as it could impact final pricing for the FOMC and impact terminal pricing as well” (a full preview is coming shortly). And while the actual inflation number may come in fractionally below or above expectations, what markets are focusing instead on – and the reason for today’s frenzied market meltup which sent risk assets to a fresh 52-week high, is what traders expect will happen not just tomorrow but over the next 2 months. That’s because according to calculations by Credit Suisse chief strategist Jonathan Golub, while tomorrow’s CPI print may come in just above the median consensus forecast, at 4.2%, it is next month’s number that will be the shocker. According to Golub, the June number (which will be released on July 12) will print at 3.2%.